CNBC recently interviewed Coinbase users across the country, discovering thousands of customer complaints against the platform.

Over the past year, the cryptocurrency industry has seen a rise in regulatory interest, ranging from institutional investors and lawmakers, to big tech and C-suite executives weighing in on the many advantages digital money brings to our financial sector, most recently with Coinbase.

However, despite the highly-teased encryption and security of financial transactions on the Blockchain, companies (and exchanges) like Coinbase still seem to miss the one issue that will take a platform like Coinbase from Heaven to “fallen angel” – account takeovers.

In a recent CNBC interview, reports revealed that Coinbase, the industry’s largest cryptocurrency exchange is also the industry’s largest platform filled with customer service complaints that involve a pattern of account takeovers and stolen funds.

Since going public in April, Coinbase, which has a market cap of approximately $65 billion, has more than 68 million users in 100-plus countries, more than 2,100 full-time employees, and $223 billion in held assets.

Coinbase CEO Brian Armstrong believes that the company going public should be viewed as a landmark moment for the crypto space as a whole. “People no longer need to be scared of it like in the early days,” Armstrong told CNBC back in April.

Yet, the crypto exchange isn’t completely absolved of the regulation concerns, with a sharp rise in the number of customer service complaints since its 2016 inception. According to reports, Coinbase users have filed more than 11,000 complaints against the exchange with the Federal Trade Commission and Consumer Financial Protection Bureau, mostly related to customer service.

Case Study: Tanja Vidovic

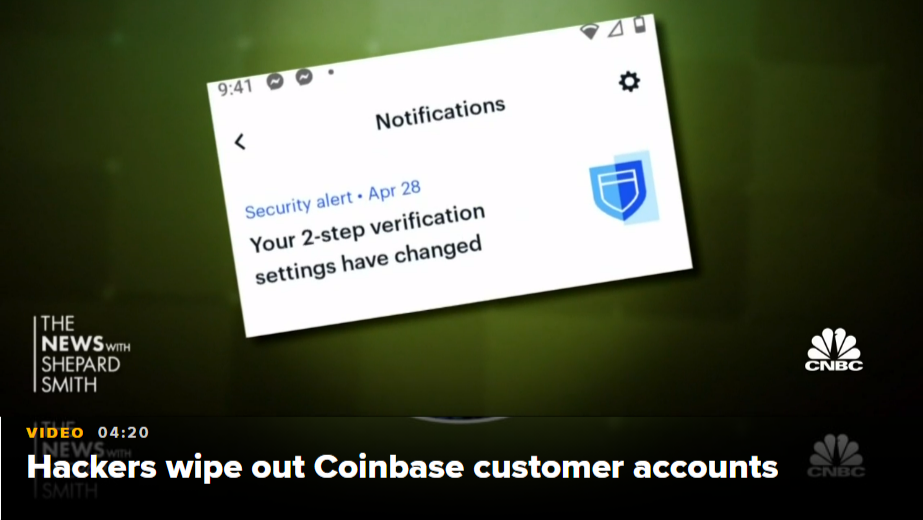

One consumer, Tanja Vidovic spoke with CNBC about a series of alerts she received about someone changing access to her crypto account. As of April 28, Tanja and her husband watched in panic as nearly all of their hard-earned investment of $168,000 in holdings disappeared, she and her husband were unable to reach anyone at Coinbase, despite four long months passing.

Both Tanja and her husband Jared first jumped into crypto investing back in 2017, watching their funds nearly quadruple over four years. After regaining access to their account earlier this month, the Vidovic’s were left with a mere $587.15 in the account and the following message from Coinbase:

“Because this attack was not the result of a breach of Coinbase security or our systems, we cannot reimburse you for this loss. This attack was only possible because the attacker had prior access to your email account and access to your 2-factor authentication codes (meaning they had access to your phone number through a SIM swap) before they attempted to access your Coinbase account,” the email said.

“I looked into Coinbase, and it seemed like it was one that everybody used and trusted,” Vidovic told CNBC. The Vidovics revealed that despite their best efforts, they were unable to get anyone from Coinbase on the phone.

This encounter is just one of thousands, where Coinbase customers have similarly revealed a pattern of account takeovers, password changes, and stolen funds which have suddenly vanished from user accounts – all with a common element: poor customer service from Coinbase, which result in just a “form-like response” that provides little to no value or solution to users.

Adding to the anger and frustration, one of the biggest downsides to the realm of digital money, is the inability for crypto transactions to be reversed, which the FBI recognizes to be a huge problem. And where do these stolen funds go?

Almost always, these funds are auctioned off for sale on the dark web, with hacked Coinbase accounts selling for $100 to $150.

In response to another Coinbase user’s complaint, the CFPB pointed to an email response from Coinbase’s Regulatory Response Team that said that Coinbase’s insurance policy does not cover theft from individual accounts.

“There is no credible or supportable evidence that the compromise of your login credentials was the fault of Coinbase,” the message said. “As a result, Coinbase is unable to reimburse you for your alleged losses.”

Bottom Line

The Better Business Bureau (BBB) reviewed a number of Coinbase’s complaints back in March, determining that the company does in fact have a “pattern of complaints from customers who state they are locked out of their accounts, even after providing required information or updates.” According to the BBB’s website, Coinbase has received 1,128 complaints in just the past three (3) years alone.

A spokesperson for Coinbase says that the company is working on its customer service and will soon be rolling out more support channels. Incidentally, it will be difficult to hone in on what these “support channels” will look like, given there is no phone access and no help being provided via email.

Time will tell, which unfortunately, is not in favor of Coinbase users.

If you think you are the victim of an account takeover, the FBI asks that you report it to your local FBI office or the Internet Crime Complaint Center at IC3.gov.

Feature image courtesy of CNBC.

Author

-

I write on the cross-section of law and entertainment at PopWrapped. Always on the lookout for stories empowering rising artists and industry professionals, while advocating against cancel culture and online bullying throughout the industry.